A New Era for ETH? ETF Inflows, Scaling To Adoption, Bitcoin Friendship, and more.

August 12, 2024

5 min read

TL;DR

-

Despite the recent market downturn, investors bought into ETH ETFs with renewed force last week, reaching first week for positive flows.

-

Ethereum’s rollup-centric roadmap is chipping away at the scalability issues that have prevented the practicality of widespread adoption.

-

Bringing BTC liquidity into the Ethereum ecosystem will begin a mutually beneficial collaboration between the ecosystems, setting aside differences.

Bitcoin created a digital currency uncorrupted by governments.

Ethereum created programmability for digital currency.

Many of us have understood the implications behind this for years. The myriad of Ethereum smart contracts deployed, articles written, and applications built is a testament to the promise we all understand.

However, we tend to forget that our niche area of tech is just that – very niche. We just convinced the traditional markets and regulators to give the O.G. cryptocurrency, BTC, a chance. It took years of education and regulatory convincing to get that done. Our reward at the beginning of summer was that bitcoin ETFs held nearly $70B in bitcoin and growing.

So how will ETH ETFs fare in comparison?

ETH ETFs Following the Leader, But More Education Needed

Source: The Block

“I think it really comes down to how advisors and distribution forces are able to make the case for Ether as the heartbeat or the headquarters for tokenization, stablecoins, and smart contract platforms.”

– Andy Baehr of CoinDesk Indices on CNBC

The launch of Ethereum ETFs has been boring. That’s not such a bad thing.

Many expected the ETH ETF inflows to be muted compared to bitcoin’s, and most expected that it would be very similar to bitcoin’s reception only on a smaller scale. Ethereum’s marketcap is about 25% that of bitcoin’s at the time of writing which is why some experts surmised that ETH ETFs reaching the range of 20% of where bitcoin products were would be a positive sign.

Ethereum inflows have been modest thus far. However, on Tuesday last week, the ETFs took on more ETH than on their debut. Additionally, the weekly ETF flows turned positive for first time since their launch. This news revives optimism that the funds will help boost the price appreciation of ETH this year. Many maintain faith that “ETF investors with long-term strategies are calmly buying Ethereum," as Swyftx’s Pav Hundal put it to Decrypt.

Of course, those who hold ETH yearn for it to surpass its all-time high in 2021, as bitcoin did earlier this year. But perhaps more importantly, gradual capital inflows to ETFs will lead to increased education, regulation, and adoption of the Ethereum ecosystem. Is Ethereum ready to take it all on?

New Scaling Advances Bring ETH Closer To Handling Adoption

Source: Wired

“Blobs are the moment where Ethereum scaling ceased to be a "zero-to-one" problem, and became a "one-to-N" problem.”

– Vitalik Buterin on his blog

Ethereum wants to be the world’s computer. It’s time to prove that it has the capacity.

Ethereum, once plagued by scalability issues, is undergoing a transformative evolution through a suite of scaling solutions. These advancements are poised to propel the network toward mass adoption by significantly increasing its capacity and efficiency.

The official Ethereum Roadmap outlines a rollup-centric vision of improvement for scalability, fee reductions, UX improvements, and more that will finally bridge the gap between Ethereum’s potential and its real-world applications. EIP-4844 (Proto-Danksharding) has pushed rollups to become many times more efficient in addition to modular DA layers, offering users a plethora of affordable options for transacting off Ethereum – great for UX but perhaps poor for ETH price appreciation.

But will the expansion of the rollup ecosystem lead to significant revenue from settlement for Ethereum and ETH appreciation? And will Ethereum maintain its status as the go-to settlement layer?

For all of the non-zero-sum speak in the Web3 space, the other matter with ETH is that it has competitors, and lots of them. In recent news, the California DMV (not particularly known for its savviness) chose the Avalanche blockchain for its efforts to digitize 42 million car titles. Future use cases from businesses and governments will naturally flow to the network that can provide the unique benefits of blockchain with the fewest limitations in efficiency, scalability, and UX.

It’s up to the Ethereum community to finish the job of adapting, educating, and innovating the ecosystem the final step of the way to viability as a replacement for centralized systems.

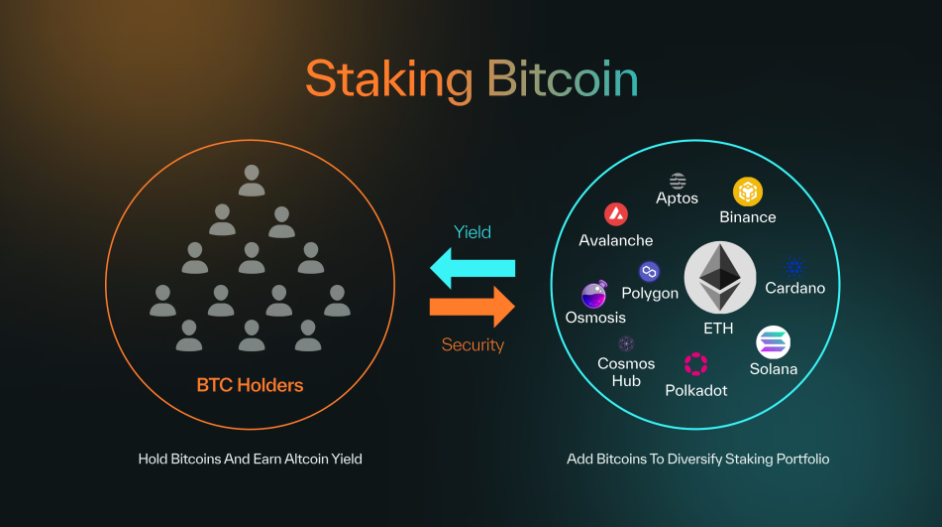

BTC Integrations Set To Flood Ethereum Ecosystem With Liquidity

Source: Babylon BTC staking protocol

“Ethereum, the biggest proof of stake system, is only 2 years old. Proof of stake is still a baby. And Babylon will nurture it.”

– David Tse, Babylon founder on X

Rollups are a core piece of Ethereum's plans to scale – what happens if every rollup could instantly tap into the $1T market cap of BTC for security? This is exactly what some protocols like Babylon and Lombard Finance are hoping to achieve with new BTC staking and restaking functionality.

By staking bitcoin on these PoS rollups, projects can significantly bolster their security posture without needing to go through the process of bootstrapping their own capital. This makes it even easier to scale Ethereum’s rollup ecosystem.

Moreover, the implications for decentralized finance are profound. If rollups can securely leverage bitcoin's market cap, it opens up a world of possibilities for cross-chain applications and interoperability. We could see the emergence of hybrid DeFi platforms that seamlessly blend the best of both worlds: Ethereum's smart contract capabilities and bitcoin's proven security and store of value properties.

This is Only the Beginning for ETH…

The confluence of ETH ETFs, scaling advancements, and bitcoin integration marks a pivotal moment for Ethereum. The potential for Ethereum to become the bedrock of a decentralized financial future is within reach. However, as Ethereum matures, it's important to remember that while the technology is groundbreaking, its adoption hinges on user experience. The complexities of blockchain technology must be abstracted away for mainstream users. Additionally, as the regulatory landscape continues to evolve, Ethereum must adapt to ensure compliance while pushing the boundaries of innovation.

Join the Conversation on Our Channels!

Twitter | Telegram | Discord | YouTube | LinkedIn | Instagram | Reddit | All Links