Ankr’s New Focus: Growing Liquidity on Fantom Chain

April 25, 2023

4 min read

Ankr is a leading provider of Web3 infrastructure, dedicated to making the decentralized world more accessible and user-friendly. Liquid staking is one of the services that Ankr offers, and it has quickly become a popular way for investors to earn rewards on their staked assets. In this article, we will explore Ankr's move to the Fantom network and how this will benefit investors.

What We’re Doing At Ankr

Ankr is a blockchain infrastructure company that provides Web3 solutions for developers, enterprises, and end-users. Ankr's mission is to create an accessible and user-friendly decentralized world, and they do this by providing a full-stack Web3 infrastructure platform that makes it easy for anyone to build, deploy, and use blockchain applications.

Ankr's platform offers a wide range of services, including node hosting, staking, and many developer-focused services like RPC nodes and app chains. The company's services are designed to be affordable, scalable, and secure, making it easy for developers to build decentralized applications and for end-users to access them.

Liquid Staking

Liquid staking is a relatively new concept in the world of blockchain, and it allows investors to earn rewards on their staked assets without sacrificing liquidity. When investors stake their assets, they are essentially locking them up in a smart contract, which makes them illiquid. However, with liquid staking, investors can receive a token that represents their staked assets, which they can then use to trade or provide liquidity in a decentralized exchange (DEX).

Ankr has quickly become a leader in the liquid staking space, with the highest Total Value Locked (TVL) for liquid staked BNB on the Binance Smart Chain using ankrBNB.

The idea behind liquid staking is to allow investors to earn staking rewards while also providing liquidity to DeFi protocols, increasing the efficiency and accessibility of these protocols. The benefits of liquid staking are significant, including increased flexibility and liquidity for investors, increased security for PoS networks, and increased efficiency of DeFi protocols.

Increased Capital Efficiency of Liquid Staking

One of the primary benefits of using liquid staking tokens in DeFi protocols is the increased capital efficiency they provide. Instead of requiring additional collateral to generate liquidity, staked tokens can be used directly, reducing the amount of capital needed to participate in DeFi activities. This increased efficiency can help drive down transaction costs and make DeFi protocols more accessible to a wider range of users. Furthermore, as the number of investors participating in liquid staking increases, the amount of staked tokens available for liquidity provision will also increase, leading to greater liquidity and more opportunities for users to participate in DeFi activities.

Using Capital Efficiency for Yield Earning

Another benefit of using liquid staking in liquidity pools is the potential for increased rewards over time. As the TVL in the pool grows, so does the value of the staked tokens, potentially leading to both staking rewards and a share of the fees generated by the liquidity pool. As more users participate in the pool, the value of the staked tokens will continue to increase, potentially leading to even greater rewards for participants. This creates a positive feedback loop where increased liquidity leads to increased rewards, which in turn attracts even more liquidity to the pool.

Ankr's Move to Fantom

Ankr is focusing on increasing its liquid staking TVL on the Fantom chain, which is known for its low transaction fees and fast confirmation times. Ankr's move to the Fantom network will provide investors with a more accessible and user-friendly platform to earn rewards on their staked assets.

First, Ankr has enabled the bridging of ankrETH to the Fantom chain. This means that investors can now stake their Ethereum-based assets on the Fantom network and earn rewards in FTM. Investors can bridge their ankrETH to the Fantom chain by using the AnkrETH bridge, which is available on the Ankr website.

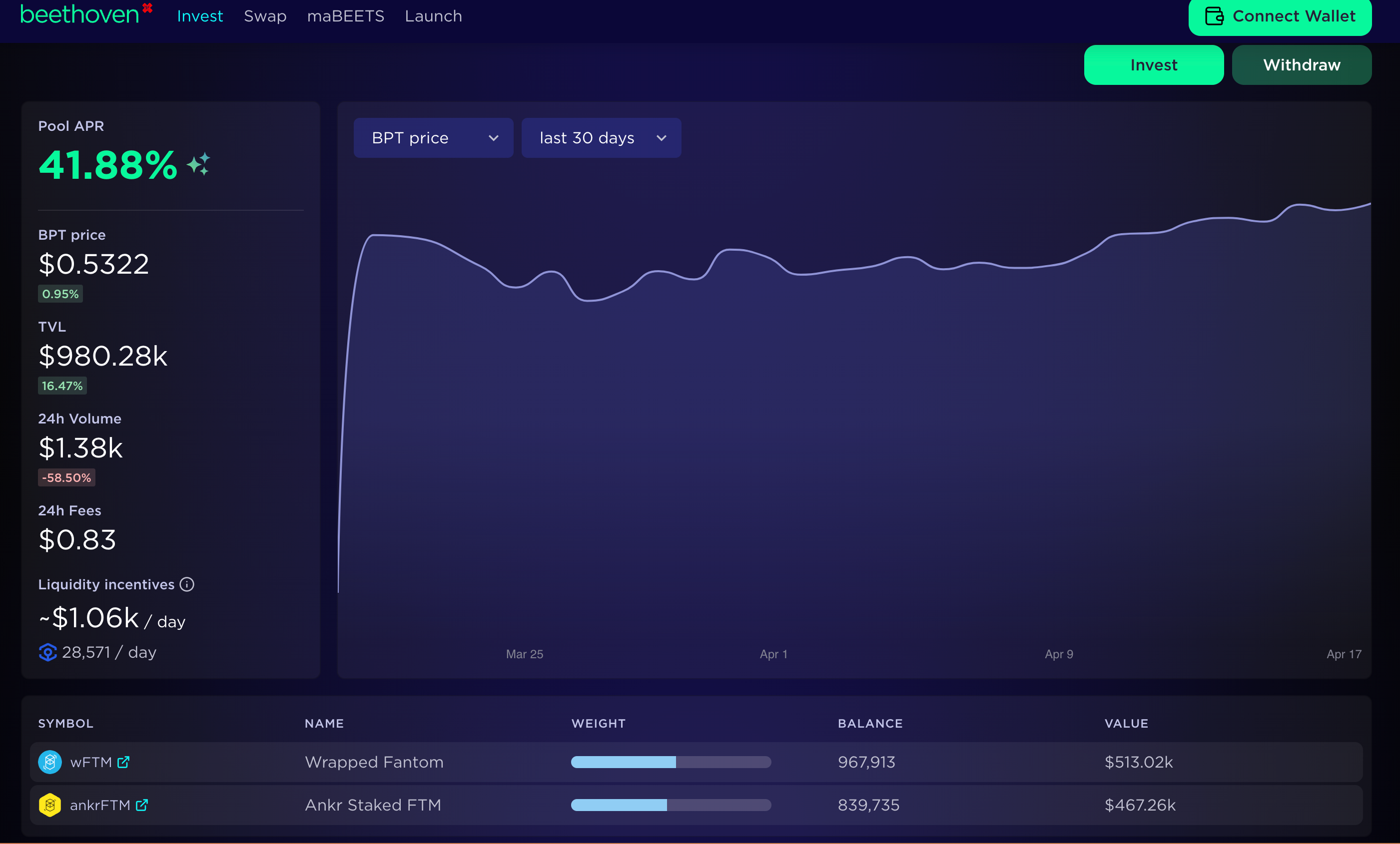

Second, ankrFTM is growing in popularity and has many utilities. The ankrFTM token is used in several liquidity pools, which allow investors to provide liquidity and earn rewards. One such pool is the Beethoven X pool, which has a total value locked of $970k and a high yield in the double digits. The Beethoven X pool is available on the Beets Finance platform and is an essential component of Ankr's broader strategy to expand its TVL on other chains.

Utilities of ankrFTM

The ankrFTM token has several utilities, including the ability to provide liquidity in various pools. The Beethoven X pool, which is available on the Beets Finance platform, is one of the most popular pools, with a total value locked of $970k and a high yield in the double digits.

Investors can provide liquidity in the Beethoven X pool by using their ankrFTM tokens. In return, they will receive LP tokens, which they can then use to trade or provide liquidity in a DEX. The Beethoven X pool is an excellent opportunity for investors to earn rewards while exploring the world of DeFi.

Conclusion

Ankr is a leading provider of Web3 infrastructure, and they are quickly becoming a popular choice for investors who want to earn rewards on their staked assets. Ankr's move to the Fantom network will provide investors with a more accessible and user-friendly approach.