Bitcoin Summer & What’s Coming for BTC: Staking, DeFi, L2s, and More

May 23, 2024

7 min read

TL;DR

- Upgrades to Bitcoin are priming the ecosystem for a fusion with Web3

- The advent of BTC Staking could fuel dividend-like yields for institutional investors like Grayscale’s new Dynamic Income Fund

- Thanks to protocols like Babylon, shared security unlocks the $1T BTC market cap and secures all PoS chains that opt-in

- L2s, BRC-20, and Bitcoin LSTs create new DeFi functionalities injected with BTC capital

For some, the utility of digital assets begins and ends with Bitcoin. The Bitcoin maximalists’ saying, “Not crypto, Bitcoin” is a point of view that P2P, electronic cash already fulfilled everything that cryptocurrency should be. However, there are those who disagree. The Web3 community responsible for every coin, blockchain, and protocol that isn’t Bitcoin has been hard at work for years, building functionality that was impossible for the first public blockchain to achieve.

Smart contracts, DeFi, oracles, NFTs, games, tokenization, governance, and so many other innovations were born from the flexibility that new Proof-of-Stake blockchains offered. However, all of Web3 put together still falls just shy of Bitcoin’s market cap. But what if we were able to merge Bitcoin’s massive capital base with Web3 functionality? By injecting BTC capital into Web3 for security and liquidity, we see an enormous upside for PoS ecosystems. Conversely, Bitcoin-first believers stand to gain new use cases, yield opportunities, and scalability that have previously been out of reach.

Will the Bitcoin community embrace new functionality? Or dismiss it? Only time will tell. But one thing is certain: builders are building regardless. The outcomes could be massive, from Bitcoin Beach all the way to Wall Street.

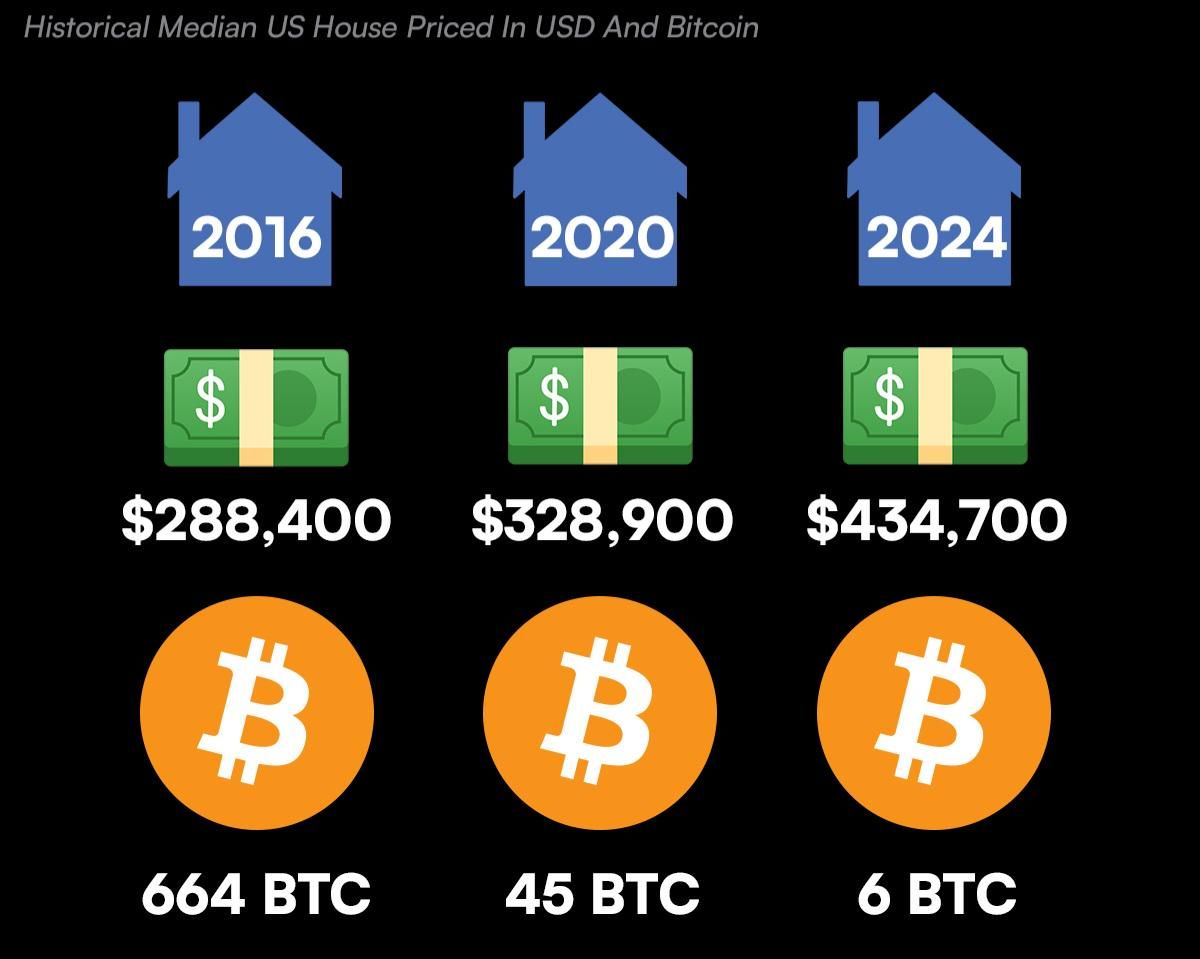

Bitcoin Makes A Stronger Case for Itself Than Ever

“Bitcoin means different things to different people. For some, it’s a risk-on asset; for others, it’s a hedge against inflation.”

– Anthony Pompliano on CNBC

At all-time highs this year after freshly approved ETFs, Bitcoin is gaining traction like never before. With traditional finance grappling with inflation and instability in certain regions, Bitcoin's appeal as a borderless, digital store of value shines even brighter. For those without access to banks, Bitcoin offers financial inclusion, while its transparent and decentralized nature can used to heal the inflationary damage done by governmental failings and corruption, as seen in countries like Argentina and El Salvador. While challenges like scalability remain, Bitcoin's unique use cases are becoming increasingly relevant.

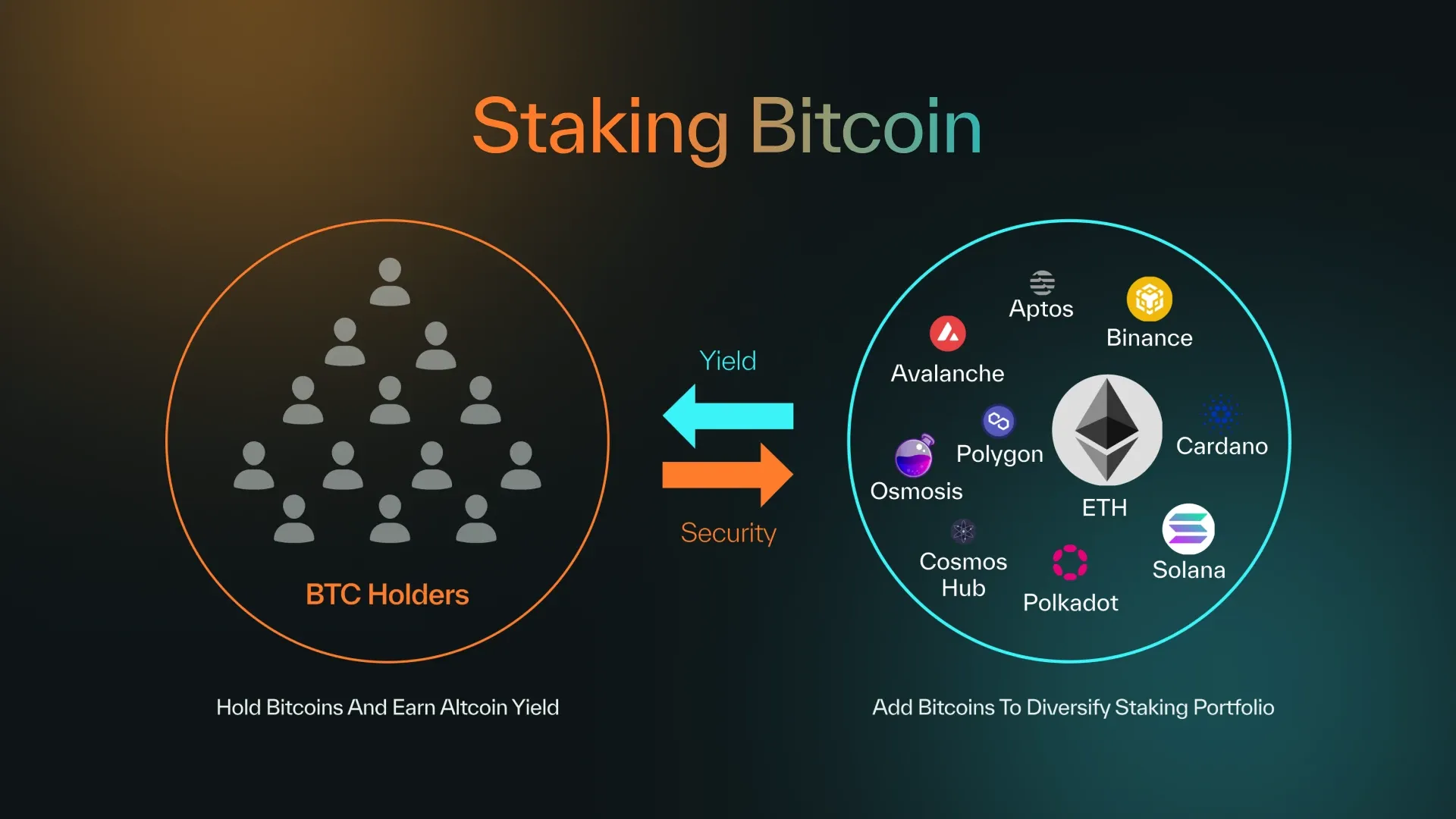

The Rise of Bitcoin Staking Provides Another Use Case: Native Yield

“We talked to many Bitcoin holders, and the first question we always ask them is, ‘What do you do with Bitcoin currently?’ And inevitably, the answer is nothing. So I think the fact that the lack of competition for other ways of earning yield bodes well for a protocol like us.”

– David Tse, Babylon Co-Founder via Coinage

The Babylon protocol is generating significant interest as its mainnet release will soon enable Bitcoin staking. This will be a major development for Bitcoin, introducing a new utility for holders around the world. By facilitating BTC holders’ participation in Proof-of-Stake (PoS) network security, Babylon will unlock vast amounts of idle Bitcoin, and integrate it into PoS ecosystems. This offers a dual benefit: PoS chains will gain the established security of Bitcoin, while Bitcoin holders earn rewards without relinquishing control of their keys (or taking them away from the security of the Bitcoin chain).

Ankr is collaborating closely with Babylon, as Ankr’s Co-Founder and CEO stated, “Ankr is proud to take its place in the technical implementation of Babylon’s Bitcoin staking and restaking mechanics. This will be an incredibly powerful protocol for both the Bitcoin community to earn yield while they hold BTC as well as the Web3 developer community to tap into a trillion dollars worth of capital to secure the next generation of apps and use cases.”

Bitcoin Staking Offers Major Opportunity To Institutional Funds

“Just as an investor in an equity ETF demands a pro-rata dividend, an Ethereum investor assertively seeks out staking rewards.”

– Martin Leinweber & Joshua Deems in Blockworks

The king of digital assets is quickly integrating itself with a growing variety of portfolios as strong Bitcoin ETF inflows continue. Additionally, new crypto staking funds like Grayscale’s Dynamic Income Fund (GDIF) will distribute staking rewards in U.S. dollars on a quarterly basis – Bitcoin staking rewards from protocols like Babylon could become an essential part of this.

Crypto custodians, exchanges, ETFs, companies, and governments hold many billions of dollars in Bitcoin. In the future, it is very likely that they will be looking for solutions like Bitcoin staking to boost yields and offer returns for their users. If they choose to stake with protocols like Babylon, it would create a massive influx of BTC to secure Web3 networks.

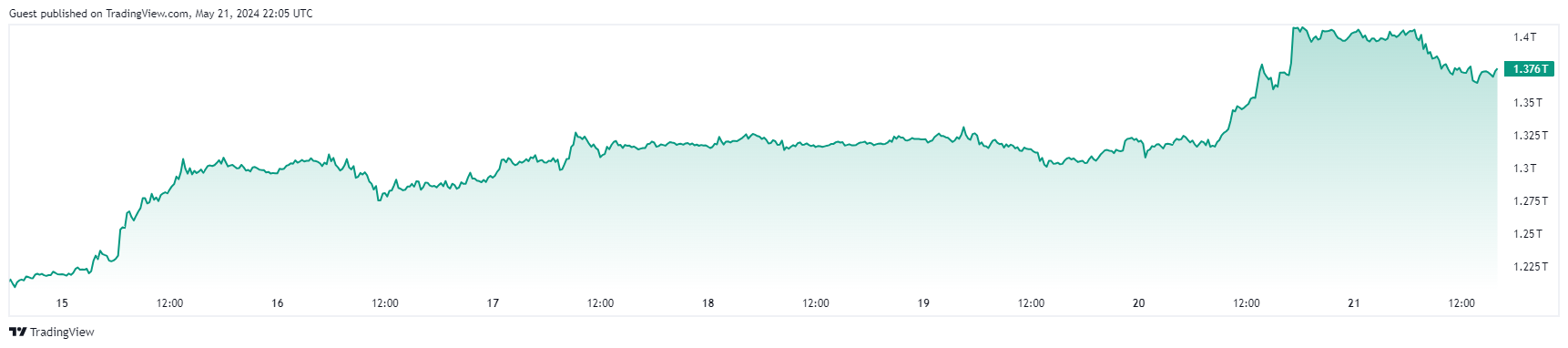

Bitcoin Liquid Restaking Creating EigenLayer for BTC

Source: TradingView. Bitcoin’s market cap over the past week rose 10% to 1.37T

Bitcoin's real potential is unlocked with liquid staking and restaking. Protocols like Babylon allow users to earn interest on their Bitcoin without giving up control of their assets, similar to Ethereum's EigenLayer. By “restaking” Liquid Staking Tokens, users will essentially be putting their staked Bitcoin to work again to secure PoS networks. Those who choose to restake, can secure other blockchains, boosting the overall DeFi ecosystem and potentially increasing the value proposition of holding Bitcoin.

Ankr’s part in this is creating the liquid staking token (LST) frameworks for the Bitcoin staked via Babylon. The LSTs will then be issued on PoS chains secured by the BTC staking protocol. For stakers, this means their BTC will be locked on the Bitcoin blockchain while new LSTs are minted on the PoS chain they chose to provide security for. In this way, both security and liquidity is provided to the PoS chains.

The Proliferation of a Bitcoin Layer 2 Ecosystem

“Lightning won’t be the only one. There’s an open market competition for other permissionless open-source protocols to this work.”

– Michael Saylor via the Lex Fridman Podcast

The Bitcoin network is experiencing a surge in layer 2 development, addressing its limitations in transaction speed and cost. These secondary protocols, like the Lightning Network and Stacks, operate on top of Bitcoin, enabling faster and cheaper transactions by processing them off-chain. This proliferation of a layer 2 ecosystem is enhancing Bitcoin's scalability and functionality, potentially unlocking its potential for wider adoption beyond just a store of value.

Layer 2 solutions built on Bitcoin allow for additional features like smart contracts and additional digital assets, expanding what Bitcoin can do. Additionally, these L2s can benefit immensely from the value of BTC capital securing them via opting into restaking protocols.

Bitcoin DeFi Unlocked By Network Upgrades, LSTs, BRC-20 Tokens

Source: CoinDesk: Bitcoin Will Power the Next DeFi Summer

Recent advancements are unlocking the potential for Decentralized Finance (DeFi) on the Bitcoin network. Traditionally, Bitcoin has focused on being a secure and censorship-resistant store of value. However, upgrades like Taproot and the emergence of protocols like Ordinals are paving the way for innovation. These advancements enable the creation of Layer 2 solutions and token standards like BRC-20, which bring functionalities like lending, borrowing, and tokenized assets to the Bitcoin ecosystem. On top of the emergence of Bitcoin LSTs, this opens doors for a wider range of DeFi applications built on the secure foundation of the Bitcoin blockchain.

Learn more about Ordinal Inscriptions & BRC-20 Tokens

This is Only the Beginning…

As the worlds of Bitcoin and Web3 continue to merge, we will begin to see some truly unique innovations. The rise of BTC staking, DeFi, and L2 ecosystems further expands Bitcoin’s functionality, potentially turning it into a powerful force not just as a store of value but as a foundation for a wide range of applications – financial and otherwise. If the Bitcoin community embraces these advancements, a future where Bitcoin and Web3 work in synergy could unlock massive opportunities for both traditional and decentralized finance.

Join the Conversation on Ankr’s Channels!

Twitter | Telegram Announcements | Telegram English Chat | Help Desk | Discord | YouTube | LinkedIn | Instagram | Ankr Staking