Blockchain’s Pulse: Current Trends In Web3 Development

June 24, 2024

6 min read

The first half of 2024 has seen monumental steps forward for the whole of the crypto and blockchain sector. Amidst a new bull market, regulatory wins, and renewed investor interest, Web3 seems to have a revived sense of purpose, leaving aside the current price downtrend.

Besides the bitcoin ETF approval, bitcoin halving, the U.S. Approval of the Crypto FIT21 Bill, and the other landmark drivers of the market this year, Web3’s development and maturation itself have played a big hand in boosting the industry. Builders have been hard at work creating shared security for Web3, new bitcoin utility, leaps forward in scaling with rollups and other upgrades moving the needle closer to full adoption.

As one of the largest Web3 infrastructure providers, Ankr has a finger on the pulse of blockchain development, as we have direct access to the critical data gathered from our array of nodes running on 55+ networks. These nodes are used globally to serve 8 billion daily requests from dApps, developers, and crypto end-users of all types, powering a large share of all Web3 traffic.

This article breaks down the most important data points gathered over the past month to discover where Web3 developers and users are focusing their efforts.

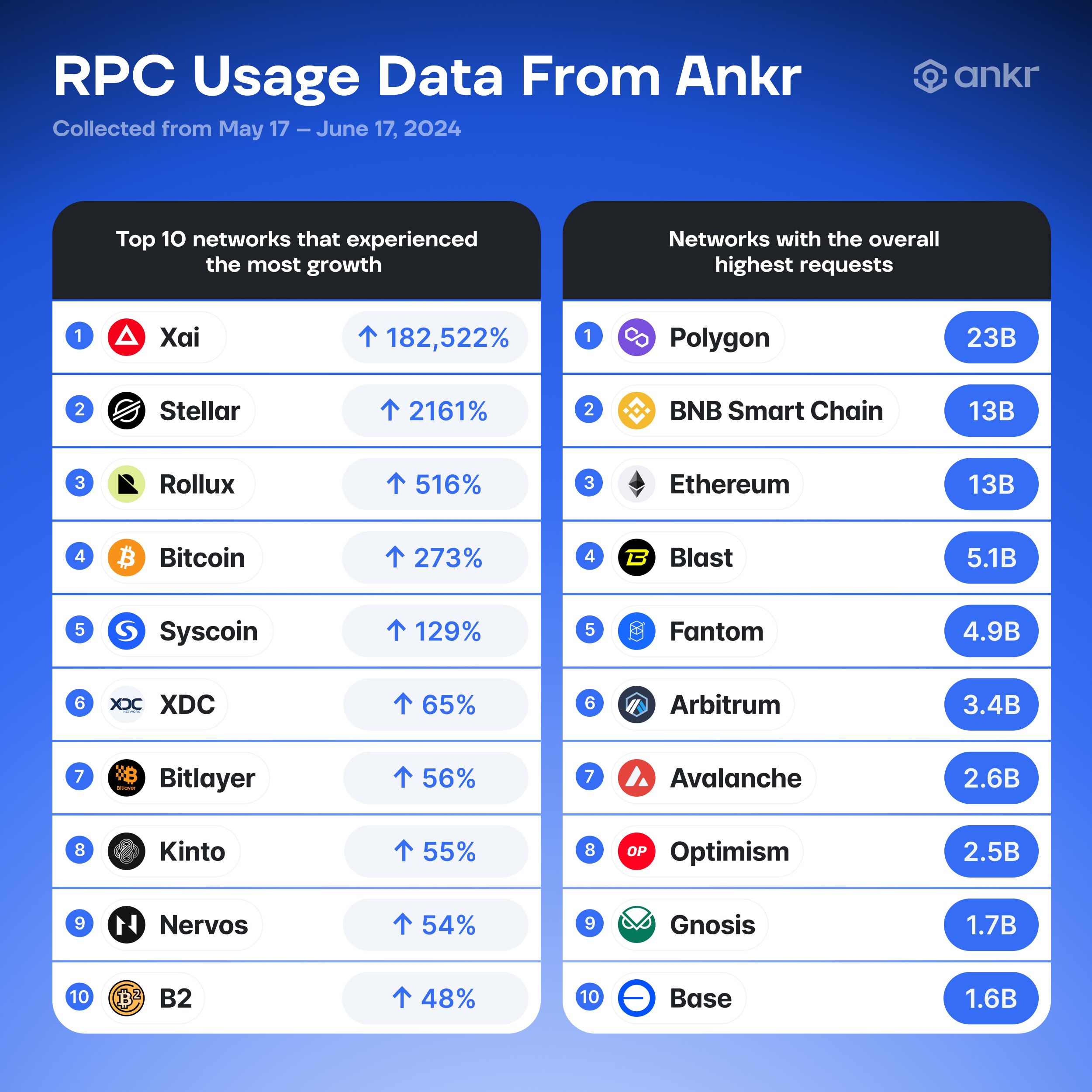

10 Networks Experiencing the Highest Growth Over the Past Month

This list shows how popular different blockchains are becoming, based on the percentage increase in how often they're used (collected from May 17 - June 17). Imagine these "uses" as conversations between applications (dApps) and the blockchain itself. These conversations, called RPC requests, happen whenever users perform actions on the blockchain. This could be anything from sending crypto to checking their wallet balance or seeing who owns a digital item. The more a blockchain is used, the more RPC requests it will have.

Keep in mind that the above stats reflect only RPC activity via Ankr’s service and may be influenced by factors such as their status as a newly added chain on our platform. However, they should paint a picture of the industry we can learn from.

1. Xai ⬆️182,522%

Xai is Layer 3 blockchain created to be powerful enough to unlock open trading for all games, including the AAA sector. Developed by Offchain Labs, Xai just achieved a record-breaking 101 TPS, and has introduced a variety of games that are designed to introduce seamless in-game trading and ownership for AAA games. Paired with their Xai Vanguard promotions, this has led to an explosion of onchain activity, development, and interest.

2. Stellar ⬆️2161%

A long-time player as a crypto payments blockchain, Stellar recently expanded its utility to welcome all developers to build applications on the Stellar mainnet via the Soroban smart contracts platform. Interest and activity are now sky-high as we saw a 2,161% increase in calls to our Stellar Horizon API used to submit transactions that interact with Soroban contracts.

3. Rollux ⬆️516%

As the bitcoin development and scaling trend continues to gain steam, Rollux (an L2 of Syscoin) is proving that other builders see bitcoin's potential to host secure, efficient, and affordable EVM rollups and dApps at scale as RPC requests grew by 516%.

4. Bitcoin ⬆️273%

After Ankr launched our bitcoin RPC on March 5th, the OG blockchain has seen tremendous interest as developers seek to explore the potential in L2s, BRC-20, bitcoin staking, and other new functionalities.

5. Syscoin ⬆️129%

Continuing the trend of bitcoin development, builder interest seems high in Syscoin as the first protocol to create a dual-chain Layer 1 that blends bitcoin's proven Proof-of-Work (PoW) consensus with EVM compatibility and modularity.

6. XDC ⬆️ 65%

As the red-hot trend of tokenization for real-world assets and financial instruments continues, XDC calls have been soaring as the chain's express purpose is for digitizing and tokenizing trade finance.

7. Bitlayer ⬆️56%

Another bitcoin L2, Bitlayer has gained developer attention as the first Bitcoin security-equivalent layer 2.

8. Kinto ⬆️55%

As a newly supported chain on Ankr, Kinto is a Layer 2 designed to specifically address security concerns in DeFi. It's new addition to Ankr's RPC platform and security benefits for DeFi have won the chain an sharp increase in activity.

9. Nervos ⬆️54%

Long-time modular blockchain network Nervos may be seeing increased activity due to builder demand for secure, flexible, and interoperable protocols at the rise of the modular revolution driving the blockchain scalability effort.

10. B² ⬆️48%

B² is seeing growth from the tide rising all bitcoin Layer 2 ships as well as from its own clear merits as a performant solution bringing fast transactions, seamless wallet access, and a DA layer that allowing any ZK-Rollup to settle to Bitcoin.

Macro Trends Behind the Top Chains

To no surprise, the same trends leading market appreciation this year seem to be the factors behind the leap in onchain activity and development seen above.

Bitcoin Evolving Far Beyond P2P Payments

Bitcoin's initial purpose of disrupting traditional finance with peer-to-peer payments was groundbreaking. However, its limited transaction capacity and functionality restricted its broader impact. This is where the recent surge in Ordinals, Inscriptions, BRC-20 tokens, Bitcoin staking, and L2 scaling solutions comes in. These innovations address Bitcoin's limitations and unlock its potential as a foundational technology. As more developers become interested in unlocking these new use cases for the bitcoin network with chains like Rollux, Syscoin, Bitlayer, B² and more, we have seen a spike in the number of RPC requests to these networks through our service.

Read more: Bitcoin Summer & What’s Coming for BTC: Staking, DeFi, L2s, and More

Tokenization of Real-World Assets

Tokenization has been the talk of the town as the largest financial companies seem to be doubling down on their tokenization strategies. Bohemoths like Blackrock are now directly funding companies to continue building out the infrastructure it will take to properly move traditional assets onto blockchain rails. Networks like Stellar, XDC, and more who are focused on asset tokenization and speedy payments seem to be gaining momentum as the future financial markets steer toward public blockchains.

Read more: Tokenization’s Emergence and Enterprise Use Cases

The Rise of Modular Scalability

A modular approach to scaling allows for separate execution, consensus, and data availability layers, leading to faster transactions, lower costs, and a more scalable future for blockchains. This paves the way for them to handle complex applications and a massive user base, all while remaining secure and decentralized. Networks like Nervos are well-suited for the modular future as chains like CKB sport high levels of interoperability and flexibility with support for all cryptographic primitives.

Read more: The State of Layer 2 Scaling and What the Future May Hold

Final Thoughts

Web3 is thriving in 2024 with surging interest, new regulations, and a wave of innovation. Ankr's data shows booming development surrounding Bitcoin's new functionalities, tokenization of real-world assets, and modular blockchains. As Web3 matures, Ankr is here to empower developers and users to build the decentralized future.

Join the Conversation on Ankr’s Channels!

Twitter | Telegram | Discord | YouTube | LinkedIn | Instagram | Reddit | All Links