How Ankr Optimizes ETH Staking through Actively Validated Services (AVSs)

Ankr Staking Team

March 4, 2024

4 min read

Actively Validated Services (AVS) represent a breakthrough innovation within the Ethereum Defi landscape, offering a new paradigm for security, scalability, and integration of decentralized applications (DApps).

TL;DR:

- By harnessing the trust network of Ethereum, AVSs enable protocols to bypass the need for their own costly and complex validator networks.

- Stakers on Ethereum can enhance the security of AVS protocols through EigenLayer's staking mechanism, providing opportunities for increased rewards.

- The benefits of AVSs integration include increased cost-efficiency, resource optimization, security, and scalability.

- Several solutions are emerging as frontrunners in the AVSs ecosystem, including Ethos, Brevis, EigenDA, AltLayer, and Lagrange.

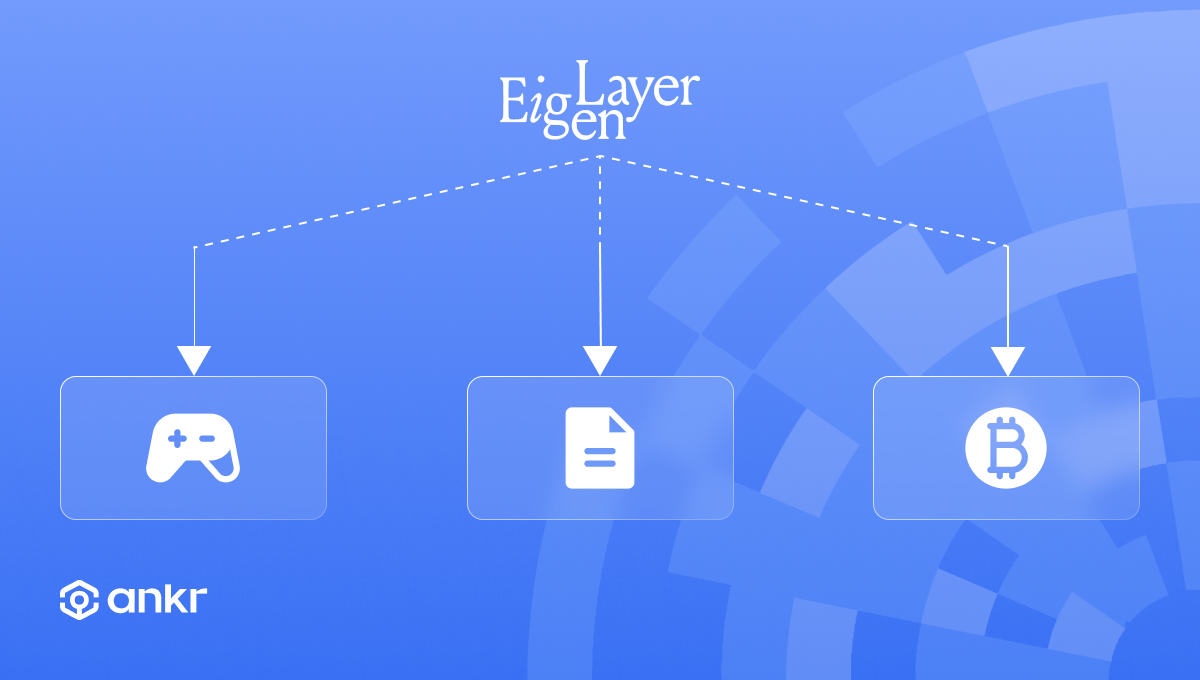

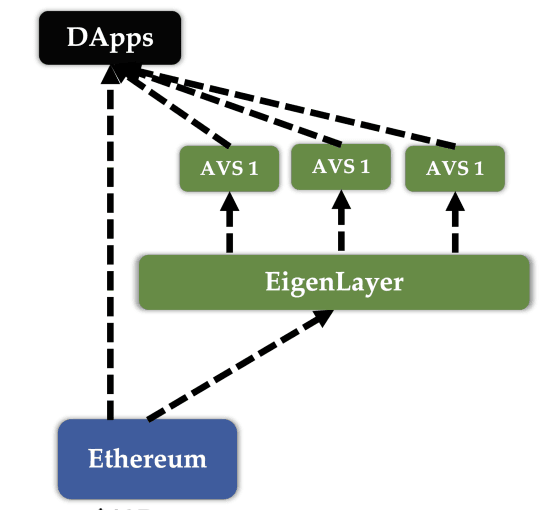

Spearheaded by EigenLayer, AVSs leverage Ethereum's existing infrastructure and validator network to ensure the integrity and reliability of blockchain services, thereby mitigating the need for protocols to establish their own, often costly, validator networks.

[2] - EigenLayer Framework (Source)

[2] - EigenLayer Framework (Source)

This novel approach enhances security and democratizes access to staking, fostering an increasingly decentralized environment and reducing the barriers to entry for DApp development.

Yield Optimization with AVSs

At its core, AVS leverages Ethereum's trust and security mechanisms, enabling DApps and systems to validate transactions and state changes using the existing Ethereum validator network.

This framework allows for the restaking of Ether (ETH), where node operators can validate Ethereum’s Proof of Stake blockchain and AVSs concurrently. Users can generate rewards by securing AVSs through staking, potentially offering a higher yield than ETH alone. However, the higher yield opportunities also carry the inherent risk of validator slashing.

How Ankr leverages AVSs through EigenLayer

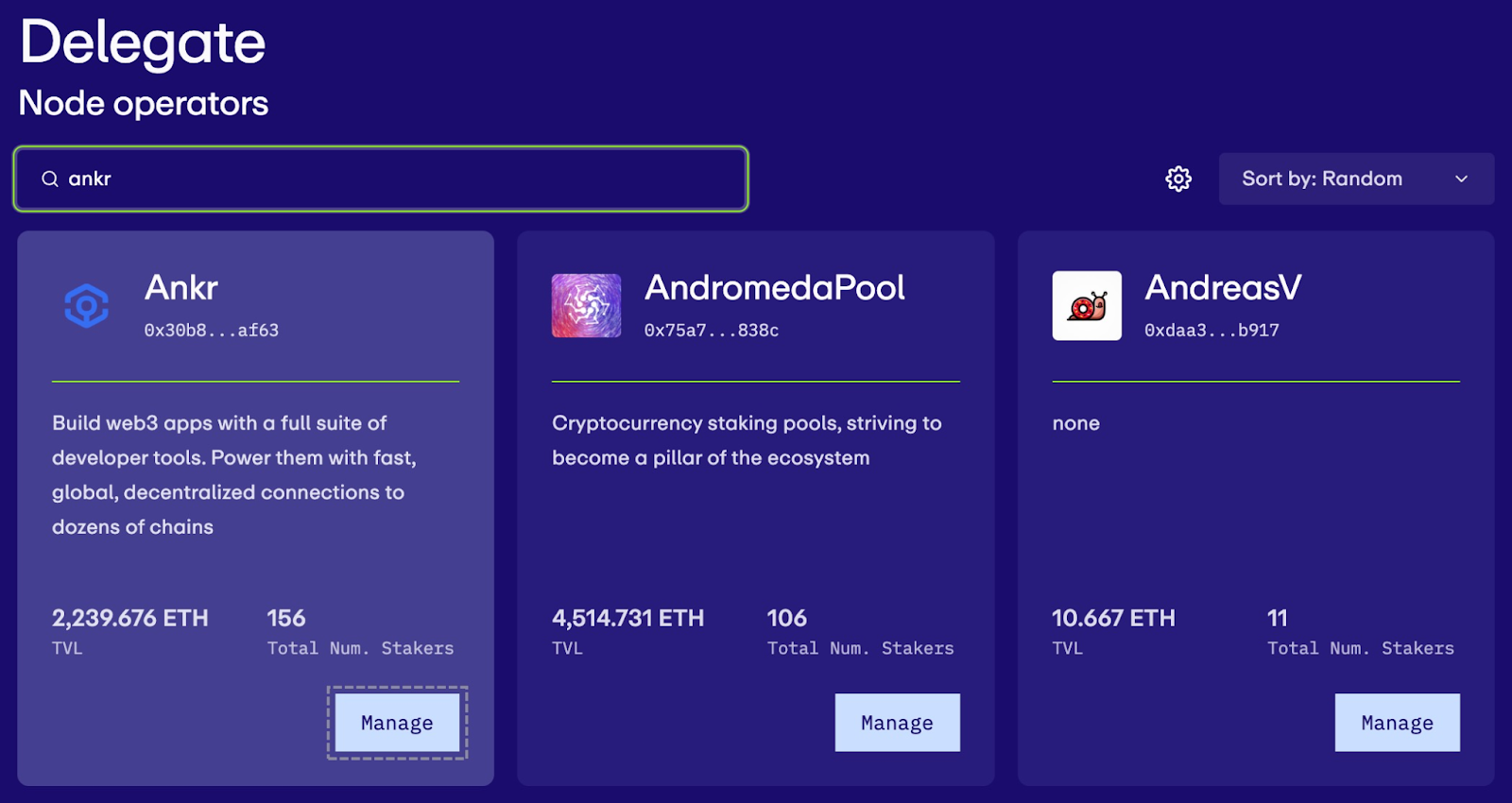

The delegating feature is expected to go live on the EigenLayer Mainnet this April. Once implemented, users will be able to restake their liquid staking tokens (ankrETH), delegating the funds to Ankr’s AVS operator.

While the delegating feature is not fully available, it is already open for testing on Goerli, one of Ethereum’s public testnets. For users interested in testing the upcoming feature, step-by-step instructions can be found on our official documentation.

[2] - EigenLayer Node Delegating Feature (Source)

[2] - EigenLayer Node Delegating Feature (Source)

The Advantages of AVSs

AVSs manage to simplify development, enhance security, boost scalability, and optimize resource utilization. These advantages collectively make AVSs a significant development in easing the incorporation of new services into the blockchain ecosystem and strengthening the network's overall robustness.

Cost-Efficiency: Launching a blockchain service traditionally requires significant investment in establishing a validator network. AVSs eliminate this barrier, allowing developers to utilize Ethereum’s existing validator network and save on costs.

Security: The decentralized nature of Ethereum's validator base offers high security, allowing new services to tap into this established framework and benefit from collective security efforts without needing to replicate such a system.

Scalability: AVSs can scale operations more efficiently by utilizing shared security and validation services, avoiding the complex process of scaling a validator network.

Resource Optimization: Validators can secure additional protocols without dedicating separate resources for each service, leading to more efficient use of staked assets and computational power.

Evaluating the Risks of AVSs

Despite the promising benefits, the integration of AVSs is not without its challenges and risks.

Concerns regarding the concentration of power among large node operators and the potential impact on Ethereum's decentralization and governance highlight the need for careful consideration.

That is why it is crucial to incorporate AVSs in a manner that aligns with Ethereum’s commitment to decentralization, open access, and community focus.

Going beyond EingenLayer

The landscape of AVSs is rapidly evolving, with several key players emerging as frontrunners in this innovative sector.

Among the most promising players in the AVS ecosystem are Ethos, Brevis, EigenDA, AltLayer, and Lagrange, each bringing unique solutions to the table.

Ethos: Integrating Ethereum's economic security within the Cosmos ecosystem, Ethos provides a bridge that enhances security and liquidity. The protocol utilizes a model that allows Ethereum stakers to leverage their holdings to secure Cosmos chains, thus introducing a new layer of economic security without the need for additional nodes.

AltLayer: Introducing a novel concept called "restaked rollups" in collaboration with EigenLayer, AltLayer aims to solve Ethereum’s scaling issues without sacrificing decentralization. This approach enables developers to quickly deploy app-specific networks, offering fast finality, decentralized sequencing, and verification. AltLayer is part of a broader move towards modular blockchains, with the aim of making Ethereum more scalable and efficient.

EigenDA: A component of the EigenLayer ecosystem, EingenDA stands out as a data availability service designed to scale with Ethereum. It leverages restaked ETH for security, aiming to offer high throughput and economic security. EigenDA is built on danksharding principles, enabling horizontal scaling and supporting a variety of use cases with its flexible architecture.

Lagrange: Focuses on infrastructure for zk-based cross-chain state and storage proofs, Lagrange brings enhanced security through restaking via EigenLayer. This initiative aims to dynamically scale underlying security for state proof generation, addressing one of the inherent challenges in achieving secure and scalable cross-chain interoperability.

Conclusion

AVSs by EigenLayer, along with promising solutions like Ethos, Brevis, EigenDA, AltLayer, and Lagrange, are setting the stage for a more secure, efficient, and innovative Ethereum ecosystem.

As Ankr continues to support the development and integration of AVSs and other innovations, our staking hub can better serve the next wave of DeFi users, enabling easy access to liquid restaking and several other yield-generating products.

Similar articles.

Restaking: The Future of Liquid Staking

Diogo Costa

September 15, 2023

Liquid staking has been a raging utility in the blockchain sphere for quite some time now, and rightfully so. Users are flocking to liquid staking...

Eigen Layer & ankrETH: Multiply Your Reward Earning Potential With Restaking

Kevin Dwyer

February 1, 2024

Exciting news awaits those who stake ETH on Ankr Staking or would like to do so soon! Starting Monday, February 5, all ETH stakers will...