Using Liquid Staking Tokens (LSTs) for Optimal Loop Strategies

Ankr Staking Team

June 14, 2024

4 min read

The staking landscape has completely changed due to Liquid Staking Tokens (LSTs), which combine the advantages of staking with the liquidity required for dynamic financial strategies in Defi.

This article explores the optimal loop strategy with Liquid Staking Tokens (LSTs) such as ankrBNB, highlighting their stable collateralization and reliable yields as key advantages.

Loop Strategies

In Defi, loop strategies involve continuously borrowing and lending assets in order to increase returns. Leveraging, Yield Farming, and interest rate arbitrage are a few examples of common strategies, where users reinvest the accrued rewards or borrowed funds to increase earnings.

These methods can lead to greater rewards, but also inherently increase the risk profile of the investment. Thus, they require careful management of collateralization ratios to avoid liquidation events.

The Benefits of LSTs in Loop Strategies

Liquid Staking Tokens (LSTs) such as ankrBNB are ideal for complex Defi Strategies since they preserve liquidity and provide continuous staking rewards. In contrast to traditional staking, which involves locked and illiquid assets, LSTs give users the opportunity to take part in other Defi activities. This dual benefit of earning and maintaining liquidity makes LSTs a superior choice for executing looping strategies. Here’s why they stand out:

- Reliable Yield

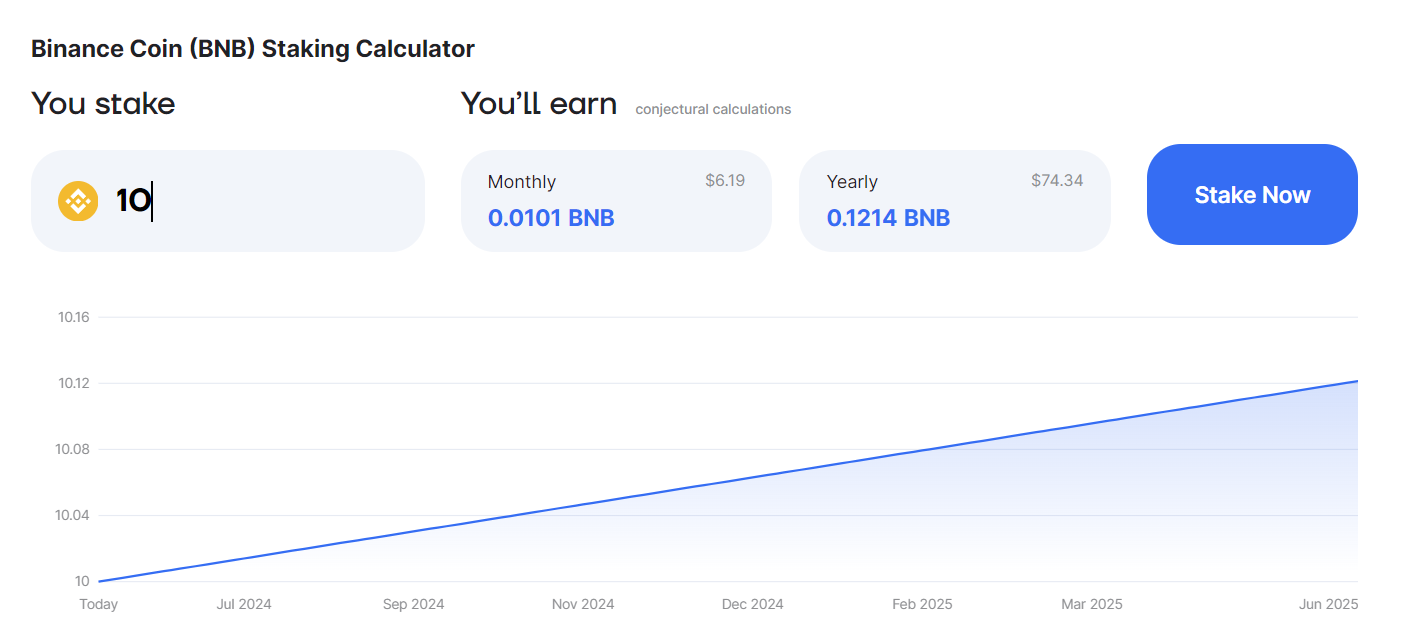

Liquid Staking and the use of LSTs produce consistent and predictable returns. Unlike variable returns from liquidity pools, staking rewards are steady and consistent. For example, ankrBNB provides staking rewards without the risk of impermanent loss, providing a dependable income stream that can be reinvested into compound earnings.

BNB Staking Rewards Calculator through Ankr (Source)

BNB Staking Rewards Calculator through Ankr (Source)

This predictability helps users plan their financial strategies more effectively and guarantees that the loop strategy remains profitable over time.

- Stable Collateralization

Liquid Staking Tokens (LSTs) provide a stable collateral base, which is critical for the integrity of loop strategies. Unlike Liquidity Pools in Decentralized Exchanges, LSTs like ankrBNB are less prone to rapid price drops and volatility.

The stability stems from their attachment to major Cryptocurrencies such as BNB or ETH, which have lower volatility than smaller, less established assets. This ensures that the collateral is stable, lowering the risk of liquidation and allowing the loop approach to operate smoothly.

When compared to typical Liquidity Pool Looping methods, LST-based strategies frequently provide higher returns while lowering risk. Traditional liquidity pools are prone to impermanent loss and require continual management to optimize yields. In contrast, LSTs provide stable and predictable returns from staking, with less exposure to market volatility.

Implementing a Loop Strategy with ankrBNB

Performing a loop strategy with LSTs involves staking native assets, such as BNB, receiving a corresponding Liquid Staking Token (LST), and use such token to borrow more native assets.

Here’s how you can achieve this with ankrBNB:

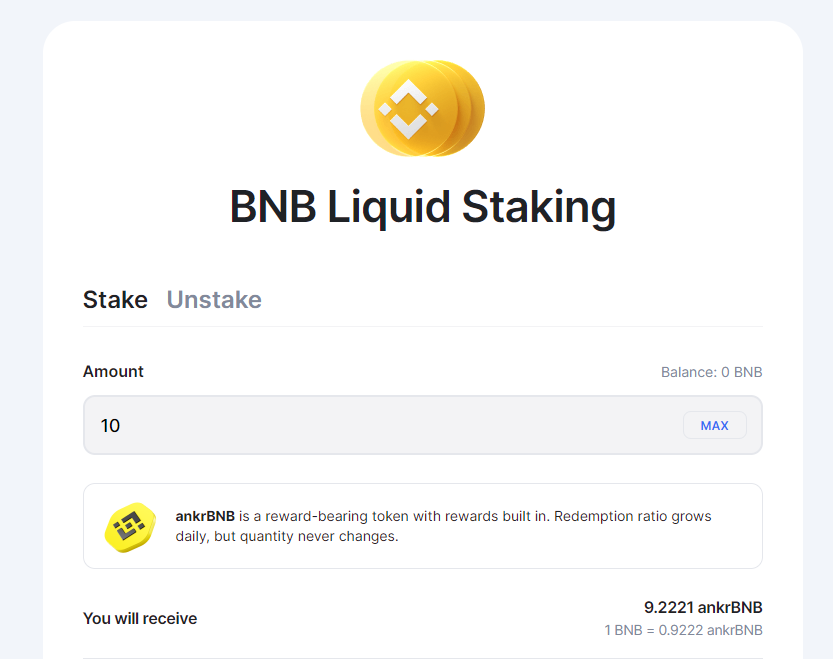

- Initial Stake: Stake BNB to obtain ankrBNB and start accruing staking rewards

Ankr BNB Liquid Staking Solution (Source)

Ankr BNB Liquid Staking Solution (Source)

- Collateralize ankrBNB: Use ankrBNB as collateral to borrow additional BNB.

- Repeat the process: Stake BNB to obtain more ankrBNB

This process creates several layers for compounding rewards. Practical scenarios illustrate the advantages of this strategy. For example, in a bullish market, the value of collateral (ankrBNB) increases in price, increasing borrowing power and potential returns.

Conclusion

Loop Strategies in Defi have the potential for significant returns but come with higher risk, especially when using traditional liquidity pools, which are volatile and subject to impermanent loss. Liquid Staking Tokens (LSTs), such as ankrBNB, offer a more stable and reliable alternative, providing continuous staking rewards while maintaining liquidity.

However, it is critical to emphasize the inherent dangers to Loop Strategies, including the possibility of liquidation if collateral values drop or if borrowing ratios are not adequately handled. Reliable Protocols such as: AAVE, Compound, or Davos Protocol can provide users with secure environments to implement these types of Complex Defi strategies. This allows users to maximize the benefits of Liquid Staking Tokens (LSTs) while effectively managing risks.

Exploring various Defi Protocols and knowing industry best practices will assist users in developing diverse and robust Loop strategies, optimizing returns while minimizing risks in the ever-changing landscape of Defi.

For those looking to take advantage of these strategies, consider exploring Ankr Staking and it’s Liquid Staking solutions and start benefiting from stability and reliable yields: