Liquid Staking: A Comprehensive Guide [2024]

Ankr Staking Team

March 20, 2024

9 min read

What Is a Liquid Staking Token (LST)?

Ankr was the original pioneer behind liquid staking, an innovative financial mechanism that unlocks the value of staked assets and improves the capital efficiency of Proof-of-Stake networks.

Users who engage with liquid staking receive a proportional amount of liquid staking tokens. These tokens, representing the value of the staked assets plus staking rewards, can then be traded or used in DeFi protocols, thus enhancing liquidity and utility within the blockchain ecosystem.

This article delves into the liquid staking model, offering guidance for participation and highlighting prominent projects in the space.

Stake 8+ Tokens With Ankr Staking Now

What is Liquidity from an Economic Perspective?

Liquidity refers to the ease with which an asset can be converted into cash or another asset without significantly affecting its price. In regard to liquid staking, “liquid” means that the value of your staked assets can still be used in DeFi or trading, unlike traditional staking.

High liquidity is crucial in financial markets, as it enables quick transactions, minimizes price volatility, and provides a stable environment for economic activities. Low liquidity, on the other hand, makes it almost impossible for investors to sell their assets.

How Does Liquid Staking Work?

Liquid staking allows participants to stake their crypto assets in Proof-of-Stake (PoS) blockchains, like Ethereum, and receive representative tokens in return such as ankrETH.

These tokens earn rewards while mirroring the value of the staked assets and can be used in various decentralized finance (DeFi) applications, traded, or used as collateral, while the original assets are staked and earn rewards.

How Liquid Staking Provides Liquidity to the Crypto Market?

Liquid staking introduces liquidity to the crypto market by transforming otherwise immobilized staked assets into fungible tokens that can be freely traded and utilized.

Providing liquidity to lending protocols, decentralized exchanges (DEXs), or staking protocols enhances market efficiency and opens up new opportunities for income generation and participation in DeFi activities.

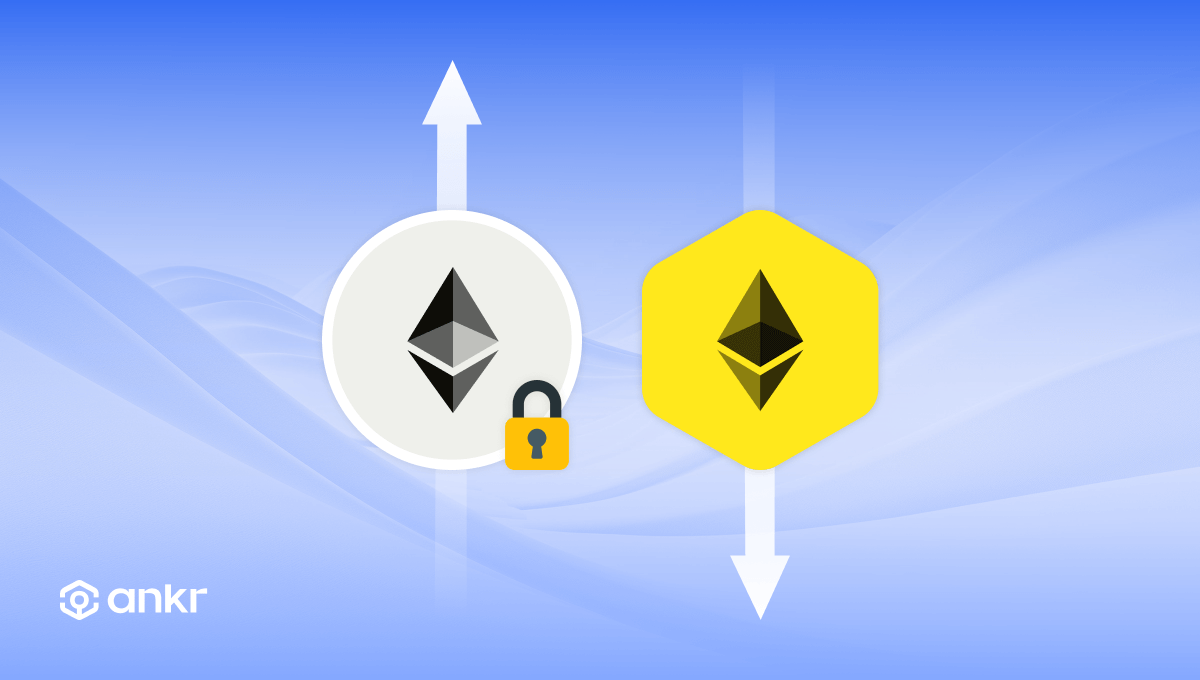

What is the difference between native staking and liquid staking?

In native staking, users lock their assets in a protocol to support network security and consensus mechanisms. This method requires investors to keep their assets staked for a determined period.

On the other hand, liquid staking offers a flexible alternative by issuing liquid tokens. This approach maintains the benefits of staking, such as earning rewards and contributing to network health, without the drawbacks of asset illiquidity.

A Brief Explanation of Consensus Mechanisms

Blockchain technology hinges on consensus mechanisms like Proof of Work (PoW) and Proof of Stake (PoS) to validate transactions and secure the network. Each approach has its unique advantages and challenges.

Proof of Work (PoW)

Let us first examine PoW, the original blockchain consensus mechanism. Used by Bitcoin, PoW ensures network security through complex mathematical puzzles, which are solved using energy-intensive machines, also known as mining equipment.

Proof of Stake (PoS)

The PoS consensus mechanism, used by Ethereum after a network upgrade in 2022, offers a more eco-friendly approach. This method selects validators to create new blocks and validate transactions based on the number of coins they hold and are willing to "stake" as collateral.

PoS enhances network scalability and transaction speed, encouraging more nodes and fostering a decentralized and resilient network structure. However, despite its advantages, PoS faces criticism for potentially centralizing power among the wealthiest stakeholders.

Benefits of Liquid Staking

Liquid staking offers numerous benefits, including improved liquidity, flexibility in asset management, participation in multiple DeFi applications without un-staking, and the potential for higher yields through diverse income streams.

The Most Reliable Liquid Staking Platforms

Several platforms offer liquid staking services, with Ankr being a pioneering and reliable provider.

Other notable platforms include Lido, Rocket Pool, and Mantle, each offering unique features and supported assets. Binance, one of the leading crypto exchanges, also offers its own Ethereum liquid staking token.

How Ankr Was a Pioneer Providing Liquid Staking Service?

The historical significance of Ankr can not be overstated, as well as its contribution to building the foundation for a more accessible Web3 space.

- The first protocol to create Ethereum liquid staking

Ankr was the first protocol to pioneer the integration of liquid staking on Ethereum, revolutionizing how billions in TVL (Total Value Locked) could be deployed into DeFi.

- The first protocol to enable liquid-staked ETH to be unstaked

Following Ethereum’s Shanghai upgrade in April 2023, Ankr became the first provider to enable the unstaking of liquid-staked Ethereum.

- Setting a standard for the industry

Ankr has differentiated itself through its dedication to innovation, constantly adding new features, developing multi-chain support, and unlocking staking and restaking options for great DeFi composability.

The company also offers a vast line of products catered towards building a more decentralized and connected Web3 infrastructure. Beyond staking, Ankr offers premium node hosting, developer tools, dedicated scaling solutions (rollups and sidechains), and several other services.

Ankr's Liquid Staking vs. Other Platforms

Why Stake With Ankr?

Ankr's liquid staking offers numerous benefits, particularly in terms of liquidity, security, and the opportunity for higher yields across multiple blockchains. Read below to learn what makes Ankr stand out as one of the go-to platforms for liquid staking.

- Robust Security Measures: With audited smart contracts and a focus on minimizing risks like de-pegging and liquidity shortages, Ankr provides a secure environment for staking assets.

- Higher Yields: Ankr Earn allows DeFi users to stake tokens for higher yields, potentially boosting earnings in the DeFi ecosystem by keeping liquidity.

- Support for Multiple Blockchains: Ankr's chain-agnostic approach supports connections to a wide array of blockchains. Our users can stake multiple assets and bridge ankrETH to different chains seamlessly.

- Diverse Earning Strategies: Liquid staking with Ankr allows for a base layer of staking rewards, plus additional earning strategies through DeFi protocols where users can lend, borrow, and yield farm.

- Distributed Validator Technology (DVT): Ankr’s collaboration with SSV.network has enabled the integration of DVT, making it possible to create liquid staking solutions that are completely trustless and non-custodial.

- Flash unstake feature: The flash unstake feature was first implemented on ankrBNB and then extended to ankrETH. It enables holders of our liquid staking tokens on the Ethereum and Binance Smart Chain (BNB) network to gain access to instant liquidity and extra flexibility for DeFi investments.

- Integration with EigenLayer: Our users can restake their ankrETH tokens thanks to EingenLayer, enabling them to accrue additional rewards.

Risks and Drawbacks of Liquid Staking

While Ankr prioritizes security and user-friendliness, liquid staking involves several risks and complexities. Here is a list of factors to consider before using Ankr or any other liquid staking protocol.

- Complex Asset Recovery: Recovering staked assets can become complicated if derived assets are reinvested on platforms with conflicting smart contract regulations, potentially making it challenging to retrieve the original staked assets.

- Potential for Smart Contract Vulnerabilities: Like all DeFi platforms, Ankr's system relies on smart contracts, which, despite audits and thorough security measures, can still be susceptible to bugs or exploits.

- Market Risks: The value of liquid staking tokens is pegged to the base asset. Any de-pegging could affect the liquid staking token's value, introducing market risks.

- Slashing Risks: While Ankr mitigates this risk by selecting high-performing validators, the inherent risk of slashing (penalties for validators' misbehavior) could impact rewards.

- Dependence on PoS Network Growth: The value proposition of liquid staking and platforms like Ankr is closely tied to the growth and stability of PoS networks. Any fundamental issues with these networks could impact the effectiveness of liquid staking.

- Fees: Fees must be factored in when calculating staking rewards. The costs will vary depending on the blockchain used for liquid staking.

Is Liquid Staking Safe?

While liquid staking introduces innovative opportunities, it also comes with risks like security vulnerabilities, low liquidity, and de-pegging issues. Platforms like Ankr mitigate these risks through rigorous security practices, but users should conduct thorough research and consider the inherent risks.

How Much Profit Does Liquid Staking Provide?

The profit from liquid staking varies based on the platform, the staked asset, and market conditions. While it often offers higher returns than traditional staking or savings accounts, it's essential to factor in the risks and rewards specific to each liquid staking platform.

To better grasp how much profit can be generated, use Ankr’s Staking Calculator.

Liquid Staking Tokens (LSTs) and Liquid Staking Derivatives (LSDs)

- Liquid Staking Tokens (LSTs) represent staked assets in liquid form, allowing users to engage in various economic activities while earning staking rewards. These tokens maintain a connection to the underlying staked asset, ensuring that users can benefit from both liquidity and income generation.

- Liquid Staking Derivatives (LSDs) are similar to LSTs but are designed to offer additional flexibility and risk management options. These derivatives can include terms for leveraging, hedging, and other advanced financial strategies, catering to more sophisticated investors.

Start Earning While You Hold Your Crypto! Liquid Staking Walkthrough

Getting started with ETH liquid staking involves choosing a reputable platform, staking your assets according to the platform's guidelines, and receiving liquid tokens in return.

Pre-requisites:

- Set up a Web3 wallet like Metamask. Here are the download link and instructions.

- Ensure you are using Google Chrome or a Chromium-based browser like Brave or Opera.

Connect your Wallet to ANKR:

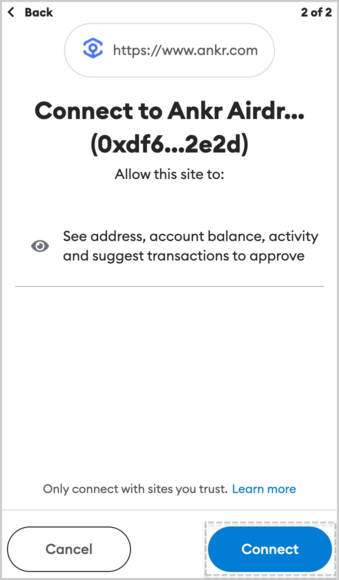

The next step is connecting the wallet to the chosen platform. Make sure to connect your wallet to the official platform, always checking the website’s URL (https://www.ankr.com/) to avoid having your funds stolen.

- Access the Ankr Staking Dashboard. Click on ‘Connect wallet’ at the top right corner.

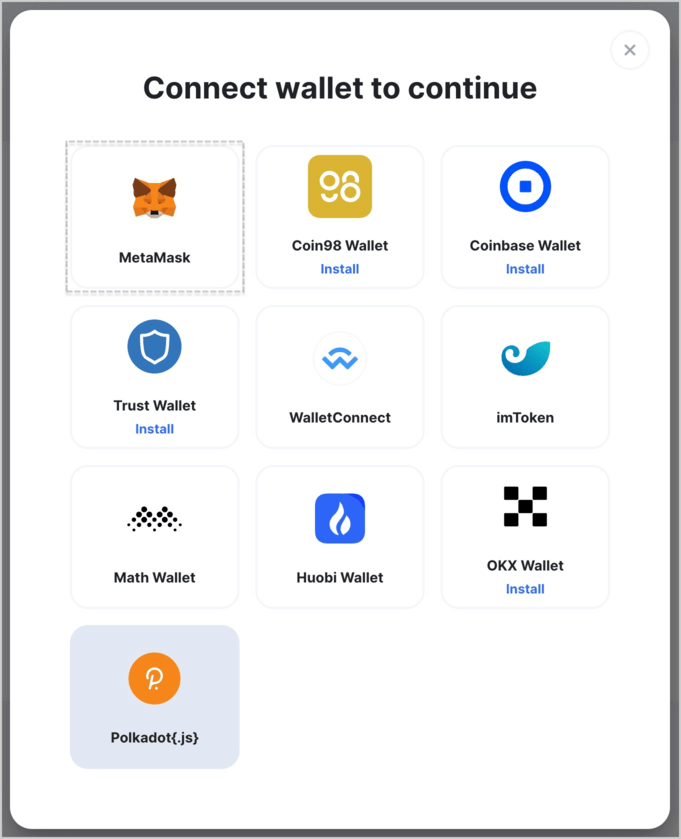

- Choose MetaMask Wallet

- Click Connect and wait for the connection process to complete.

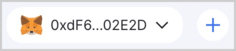

3.1. A successful connection is indicated by your wallet address being displayed at the top right corner.

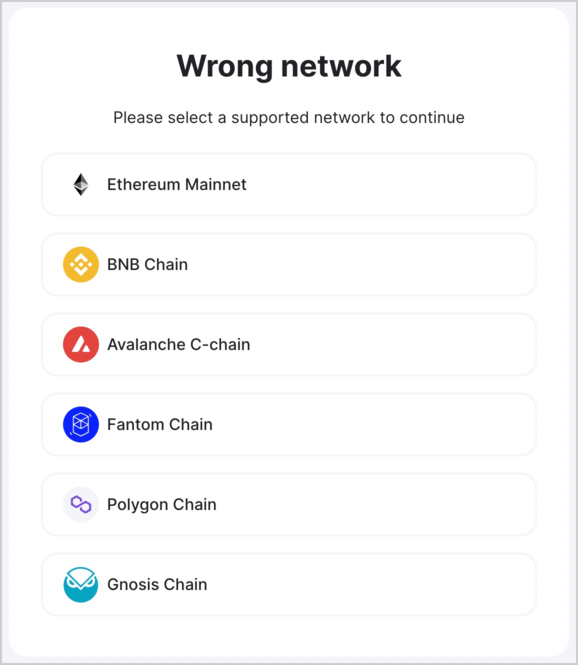

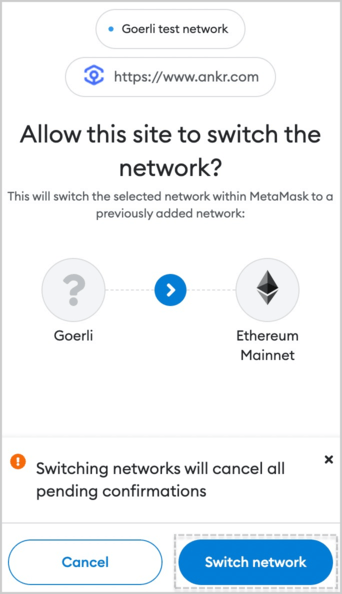

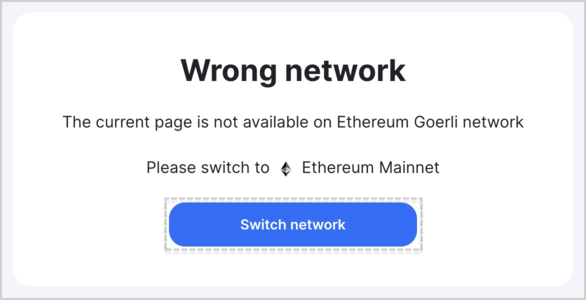

3.2. (Optional) Network Switch: If prompted by Ankr Staking to switch networks, select the Ethereum Mainnet.

3.2.1. Click Switch network to confirm the change.

Stake Your ANKR Tokens

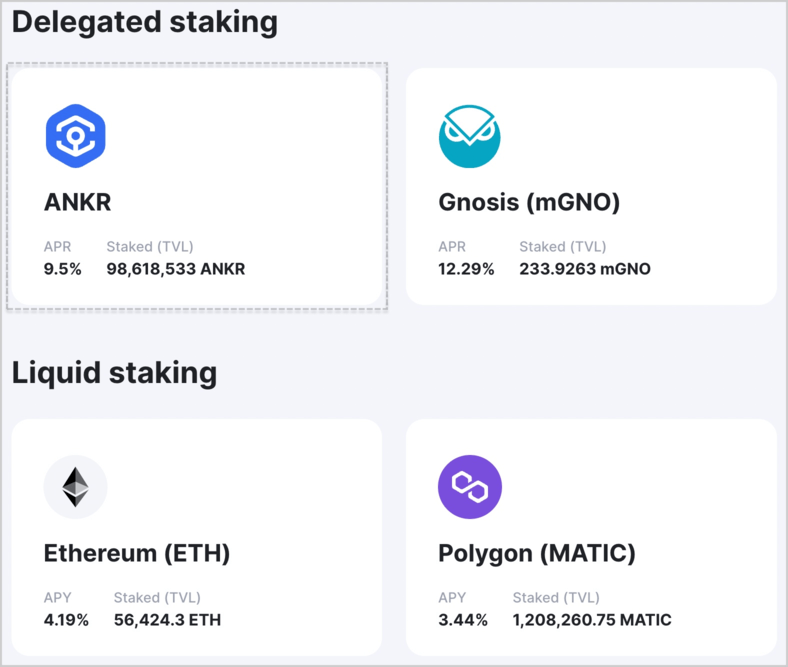

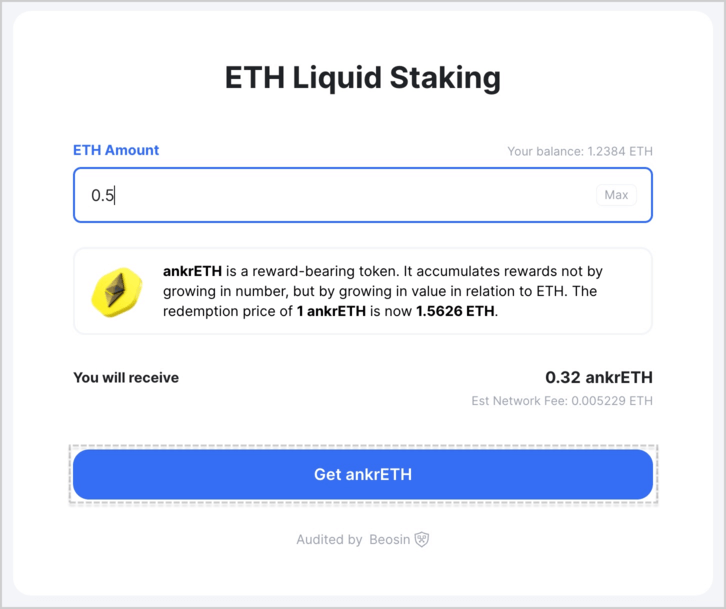

1 - Access the Ankr Staking page. Look for the Ethereum (ETH) option and click Stake.

2 - If you're prompted to switch to a specific network in MetaMask, click Switch network and confirm.

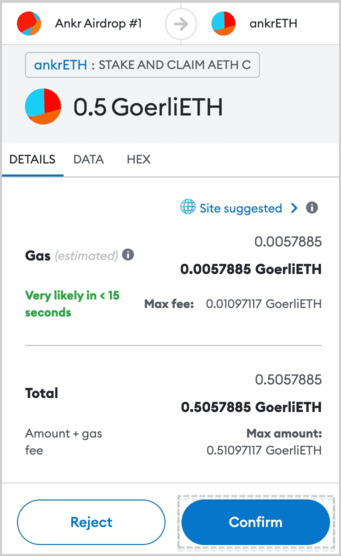

3 - Enter the amount of ETH you wish to stake and click Approve, granting Ankr Staking access to your tokens.

4 - Confirm the request in the MetaMask wallet.

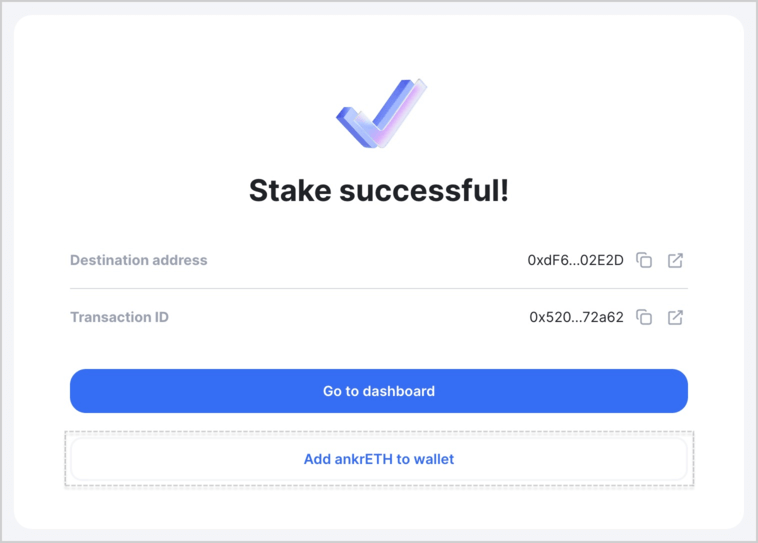

5 - Wait for the ‘Stake successful!’ message. This might take a few moments as the transaction finalizes.

You can now view your staked ETH on the Ankr Staking Dashboard.

Cryptos Available on Ankr's Platform

Ankr supports a wide range of cryptocurrencies for liquid staking, including:

- Ethereum Staking (ETH)

- Polygon Staking (MATIC)

- Avalanche Staking (AVAX)

- Binance Coin Staking (BNB)

- Fantom Staking (FTM)

By enabling liquid staking of multiple assets, Ankr ensures its user base can employ various investment strategies and be free to explore the DeFi ecosystems on different chains.

Join the Conversation on Ankr’s Channels!

Twitter | Telegram Announcements | Telegram English Chat | Help Desk | Discord | YouTube | LinkedIn | Instagram | Ankr Staking

Similar articles.

Liquid staking: The DeFi upgrade

Decentralized finance (DeFi) signaled the beginning of a new era in the history of crypto assets. Unlike conventional finance, it does away with the necessity...

Traditional vs. Flash Unstaking: Understanding the Difference

Ethan Nelson

February 14, 2023

Although staking is seen as one of the most reliable ways to earn yield in crypto, the unstaking process is by far the most robust...

Restaking: The Future of Liquid Staking

Diogo Costa

September 15, 2023

Liquid staking has been a raging utility in the blockchain sphere for quite some time now, and rightfully so. Users are flocking to liquid staking...

Eigen Layer & ankrETH: Multiply Your Reward Earning Potential With Restaking

Kevin Dwyer

February 1, 2024

Exciting news awaits those who stake ETH on Ankr Staking or would like to do so soon! Starting Monday, February 5, all ETH stakers will...