Midas Capital and Ankr: Empowering DeFi Users with Innovative Liquidity Solutions

May 15, 2023

5 min read

This article is a guest post written by Carlos Mazzaferro, the CTO of Midas Capital.

TLDR: By leveraging Midas’ unique borrowing, lending, and yield capabilities, Ankr is revolutionizing the DeFi space by enabling the widespread adoption of Liquid Staked Derivatives (LSDs) as a core component of major DeFi systems. This enables higher capital efficiency, increased yield opportunities, and increased total value locked securing a chain's consensus.

In particular, by leveraging LSDs to their full DeFi extent, Ankr is enabling users to take part in the same DeFi activities as before (e.g. liquidity provision to AMMs and Money Markets, borrowing and lending, leverage farming) but with far higher yields & capital efficiency & lower costs.

What is Ankr?

Ankr is web3 infra with liquid staking pools on ETH, Polygon, BNB, AVAX, FTM, DOT and Gnosis. Ankr liquid staking pools combine over 100M in TVL with the biggest pools on ETH and BNB.

Ankr is leading the space in terms of providing more capital efficient manners of liquidity provision. Their focus on incentivizing the usage of a natively-yielding token not just as investment vehicle, but also as a key component of multiple DeFi systems opens up for the users unique ways to further their earnings all the while increasing the chain’s security.

What did they need?

There are two aspects worth mentioning in terms of Ankr’s needs:

- Deepen the liquidity of the AMM liquidity pools that support Anrk’s LSD token, ankrBNB

- Increasing the utility and capital efficiency of ankrBNB, by making it a core component of money markets and AMMs

In terms of the first requirement, the Ankr Treasury was interested in a solution that would enable them to leverage their ankrBNB reserves to further deepen the liquidity of their LP pairs on an AMM exchange. In order to do so, they needed a borrowing and lending protocol that would allow for such asset to be borrowed at competitive rate.

Midas came to be the best (and only) place to do so. By allowing the collateralization of high-yield tokens such as Thena LP tokens [1] ($ankrBNB-ANKR LP, ankrBNB-HAY LP, etc.), Ankr is now able to deposit their LP tokens into Midas, borrow ankrBNB against them, and redeposit the ankrBNB into the Thena LPs.

As for the second aspect, Ankr wanted to empower their users with the ability to further increase the utility of their liquid staked derivative. By allowing users to provide liquidity to the Midas Pool in the form of ankrBNB, users are now able to further unlock their liquidity by borrowing stablecoins at a low interest rate from the pool, while earning a reliable and low risk yet high APR on their liquid stake derivative, ankrBNB.

Why did they choose Midas?

Midas allows full customization of pool parameters. Ankr is a sophisticated organization and wanted to control all aspects of the pool. The parameters they changed included:

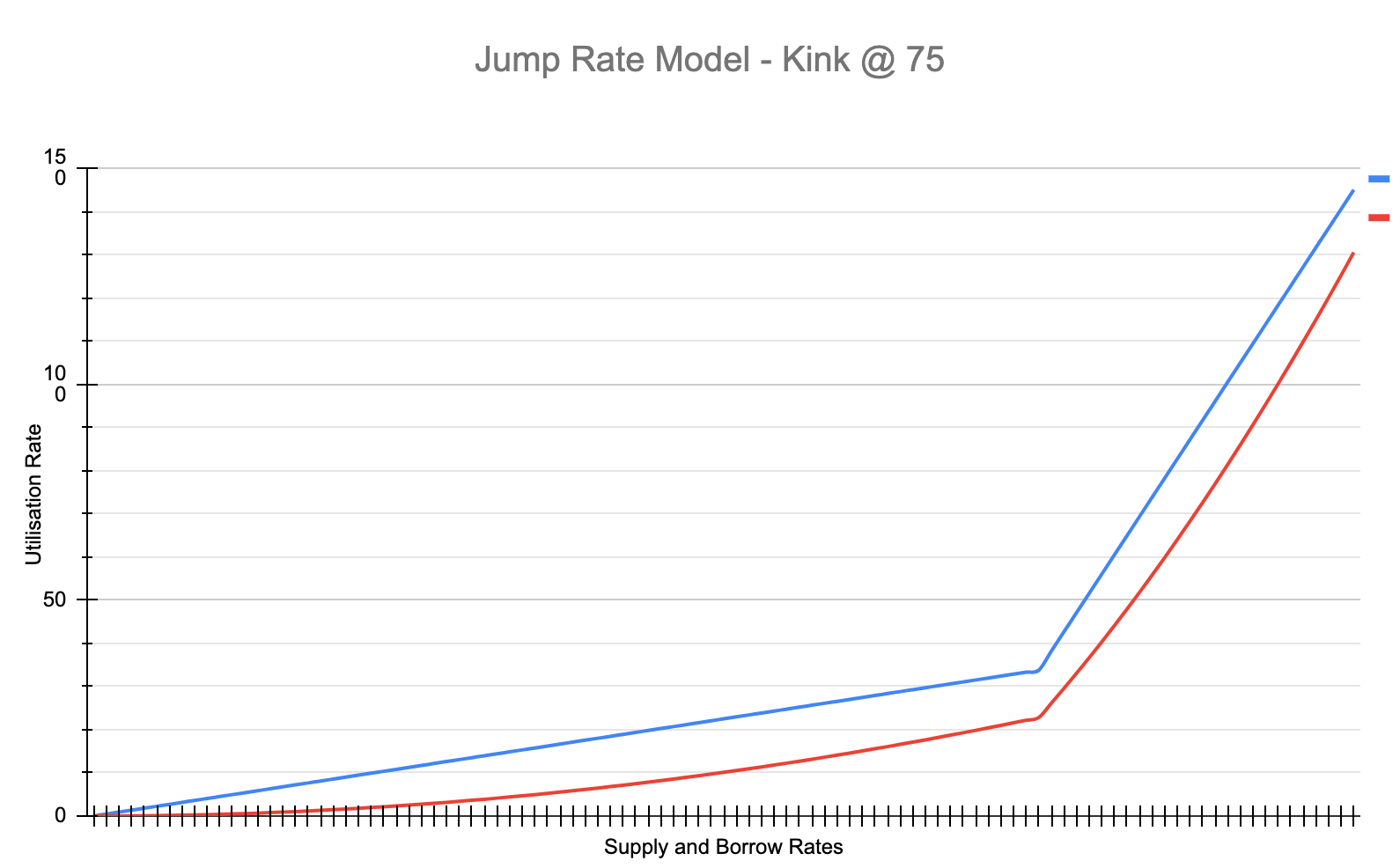

- Interest rate curves. They wanted a fully customized interest rate model that uses an oracle to determine the borrow interest based on the ankrBNB staking rewards rate, to incentivize optimal utilization.

Midas is also the only platform that is able to support a wide range of yield-bearing collaterals including LP tokens from every leading DEX. This was important for Ankr because they have various volatile and stable LPs across different platforms that they wanted in the pool.

On the security side, they wanted fine-grained control over risk parameters, a crucial feature for enabling support for long-tail assets. Midas Capital supports Debt Ceilings, Supply Caps, Borrow Caps among other security-related parameters that are controllable per pool. More info on Midas’ offerings can be found in the Midas Capital Docs.

The isolation features of Midas, meaning that other pools do not affect the Ankr pool, was also a major selling point of the Midas platform.

How did Midas solve the problem?

Midas deployed an isolated pool for Ankr focused on the ability to borrow, lend, and collateralise a variety of yield-bearing assets .

Midas developed a custom interest rate model able to effectively incentivize the optimal utilization of ankrBNB. More specifically:

- Ankr, as a leading borrower of ankrBNB, needed to be able to borrow at a cheaper rate than the APRs earned on their LP positions used to collateralize the borrows

- ankrBNB depositors needed to be able to earn higher APYs on Midas than anywhere else, so that they were incentivized to supply more ankrBNB to the pool. This creates a competitive advantage for Ankr’s liquid staking platform as they are able to offer a product with a higher yield than staking BNB elsewhere, which will attract more BNB to be staked with Ankr and solidify Ankr’s position as a leader in the space.

- We developed an Interest Rate Curve that incentivized the borrow rate of ankrBNB to match the average yield across the other collateral token supplied at the optimal utilization rate of 75%. To give a concrete example:

- Collateral HAY-ankrBNB LP → avg 40% APY

- Collateral ANKR-ankrBNB LP → avg 35% APY

- Collateral HAY-BUSD LP → avg 25% APY

- Borrowable ankrBNB rate: set at 33% when there’s 75 % utilization of the pool

- The final model parameters and formula can be found here

What was the process?

Discussion and brainstorming with Ankr about the potential mutual benefits and modes of interaction between the protocols. Mapped out the pool requirements including collaterals supported, borrowable assets, and risk parameters.

Discussed and implemented the advanced mechanics of the pool including:

- Yield capabilities of the pool

- ERC4626 strategies for the collateral tokens

- Liquidity mining rewards to be issued, both in ANKR and HAY

- Optimal Interest Rate Curve definition

After mapping everything out, we created the pool using Midas’s intuitive no-code UI for pool creators.

Furthering the effectiveness of this solution is the fact that Midas’s markets are powered by the ERC4626 standard, which allows tokens that are deposited into it to be subject to arbitrary “strategies” that allow such tokens to be used elsewhere. This allows the LP tokens deposited to be staked directly into Thena Gauges, which allows depositors to earn all the Thena rewards issued by the Gauges, without losing the ability to borrow against them. This was a particularly important requirement for Ankr, which was interested in retaining THE rewards to be able to vote in their Gauges.

Thank you for reading this guest post from the CTO of Midas Capital.

Learn more about Midas Capital and Ankr for your DeFi solutions.